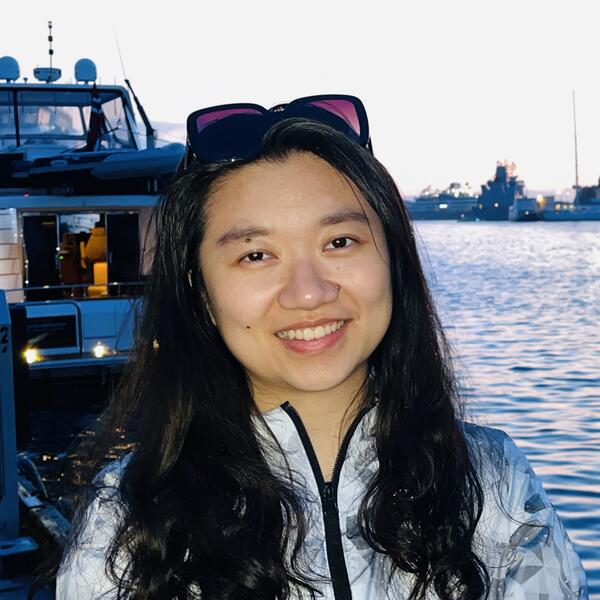

Professor Shuxing Yin

BSc, MSc, PhD

Management School

Associate Dean for Internationalisation and Reputation

Professor of Finance

+44 114 222 3344

Full contact details

Management School

Room C064

Sheffield University Management School

Conduit Road

Sheffield

S10 1FL

- Profile

-

Shuxing holds a BSc in Finance from Sichuan University (China), an MSc in International Securities and Investment Banking from ICMA centre University of Reading, and a PhD from the University of Manchester.

Before joining Sheffield University Management School in 2009, she worked as Senior Lecturer in Finance at University of Hertfordshire.

Her previous work experience also includes employment in the Investment Banking Division at Western Securities in China.

- Research interests

-

Shuxing's research interests lie in corporate finance and corporate governance. She is also interested in interdisciplinary research exploring human factors (e.g., experience, attributes) in the financial decision-making process.

She has published in academic journals of international excellence, including the Journal of Corporate Finance, the Journal of Futures Markets, the Journal of International Money and Finance, and Human Resource Management (US).

She is an Associate Editor for the European Journal of Finance and the International Journal of Finance and Economics, and an External Examiner for Postgraduate Programs at the University of Birmingham.

- Publications

-

Journal articles

- . British Journal of Management, 36(3), 1165-1186.

- . International Review of Financial Analysis, 94.

- . International Review of Economics and Finance, 85, 306-315.

- . Finance Research Letters, 46(Part B).

- . The Manchester School, 89(5), 507-525.

- . International Business Review, 30(5).

- . Journal of Empirical Finance, 61, 139-162.

- . Cambridge Journal of Economics, 45(1), 85-108.

- . The Manchester School, 89(5), 486-506.

- . Review of Quantitative Finance and Accounting, 54(1), 69-110.

- . Journal of the Operational Research Society, 70(10), 1709-1719.

- . International Review of Financial Analysis, 55, 60-79.

- . Journal of Corporate Finance, 47, 72-87.

- . Review of Quantitative Finance and Accounting, 1-27.

- . International Review of Financial Analysis, 49, 128-137.

- . Journal of Futures Markets, 35(12), 1173-1194.

- . Cambridge Journal of Economics.

- . Journal of International Money and Finance, 49(Part B), 470-491.

- . Journal of International Financial Markets, Institutions and Money, 33, 283-298.

- . European Journal of Finance.

- . Human Resource Management, 53(1), 179-201.

- . International Review of Financial Analysis, 29, 251-260.

- . Review of Quantitative Finance and Accounting, 1-23.

- . Accounting and Finance, 52(2), 467-493.

- . Pacific Basin Finance Journal, 18(5), 442-459.

- . International Journal of Banking Accounting and Finance, 2(4), 387-403.

- . Journal of International Financial Markets Institutions and Money, 19(5), 937-949.

- . Pacific-Basin Finance Journal, 16(5), 539-554.

- . Journal of Multinational Financial Management, 18(3), 209-228.

- Female Chief Risk Officers (Cros) and Risk-Taking in Banks.

- Independent Non-Executive Directors (Ineds) Heterogeneity and Bank Misconduct.

Conference proceedings

- Trading Activity in Options and Stock Around Price-Sensitive ¾Ã²Ý¸£Àû Announcements. Trading Activity in Options and Stock Around Price-Sensitive ¾Ã²Ý¸£Àû Announcements

- The Long Term Performance of Share-only versus unit IPOs: Evidence from Hong Kong Stock Market. The Long Term Performance of Share-only versus unit IPOs: Evidence from Hong Kong Stock Market

- Warrants in Initial Public Offerings: Empirical Evidence. Warrants in Initial Public Offerings: Empirical Evidence

- Who benefits from the IPO Allocations?. Who benefits from the IPO Allocations?

Working papers

- .

- The Hidden Information Content: Evidence from the Tone of Independent Director Reports.

Presentations

- Price Limits Performance: Evidence from the AB-Shares on the Shanghai Stock Exchange and Shenzhen Stock Exchange.

- Derivative Activities and Chinese banks' Exposures to Exchange Rate and Interest Rate Movements.

- Does stock market reward innovations: Evidence from market reactions to major negative news during the 2007-2012 global financial crisis.

Preprints

- .

- .

- .

- .

- .

- Grants

-

Title: Peer-to-peer lending market in China: Pricing, risk management and regulation

- Awarding body: ESRC-NSFC Research Grant

- Date: 2018

- People involved: Mustafa Caglayan (Heriot-Watt University), Oleksandr Talavera (Swansea University) and Ling Xiong (Robert Gordon University)

- Amount: £322,732

Title: Independent directors in China

- Awarding body: British Academy

- Date: 2019

- People involved: Khelifa Mazouz (Cardiff University)

- Amount: £7,412

- Teaching interests

-

Shuxing has previously taught modules in Corporate Finance, Portfolio Management, Equity Asset Valuation and Financial Markets.

She has been teaching a variety of students, including undergraduates, postgraduates and full-time MBA students.

She is currently the module leader Corporate Finance at the postgraduate level.

- Professional activities and memberships

-

She has acted as referee for Abacus, British Accounting Review, British Journal of Management, Cambridge Journal of Economics, Economic Modelling, Emerging Markets Finance and Trade, European Journal of Finance, European Management Review, Journal of Applied Accounting Research, Journal of Corporate Finance, Journal of Financial Stability, Journal of Futures Markets, Journal of International Financial Markets, Institutions and Money, Journal of World Business, Management and Organization Review, Quarterly Review of Economics and Finance.

- PhD Supervision

Professor Yin currently supervises:

Shuxing would welcome proposals from potential doctoral students wishing to work in the field of corporate finance, particularly focusing on internal and external governance mechanisms in emerging markets.

She would also be interested in supervising projects on initial public offerings and human capital.

Are you interested in applying for a PhD?